Do you feel that you have financial freedom? This is a tough question to answer as different people have different perspectives for their lives. But for this purpose, we will focus on the basics, not on the staff that billionaires would think of.

Let me start with statistics. According to a survey featured on PR Newswire, only 11% of Americans feel they’ve achieved financial freedom. This is not very good news for those who are reading this article right now.

You might wonder, why is financial freedom that important. Let’s say you are not worried about bills, debts, or any emergency that may come up.

To make your own decisions and follow your own desires without any worry; is just the way to be free.

Financial freedom means managing your finances rather than allowing them to manage you.

We shall now discuss 15 practical ways of achieving a greater degree of personal monetary independence in the following sections.

How to Achieve Financial Freedom

Key Takeaways

- Make a plan that reflects your financial goal. Don’t let you carried away by other people’s achievements. Set your goal according to your income.

- Track your spending, every penny is important when you are making a financial plan for your life.

- Try to automate your finances to pay bills on time and save money

- Always updating yourself with things like budgeting, credit, savings, and investing is fundamental for making informed decisions

- Pay your debt for good and TRY NOT TO take debts.

- Try to live a minimal life. Minimalism can save a significant amount of money.

Learn How to Budget

First thing first, make a budget for every month. Again, make your budget according to your income. Don’t get carried away by seeing what other people are doing, focus on what you can do and ask yourself, is that enough for you?

Begin by understanding your earnings and then plan how every dollar will be spent, ensuring that you cater to necessities, savings, and of course a bit of enjoyment.

One simple technique to get started on budgeting is the “50/30/20 rule.” Think about your monthly income as a pie. Take 50% out of the pie in terms of needs such as rent and food. 30% is hobbies or eating out while the remaining 20 % goes into saving.

This is a very basic structure but I hope now you can understand the process of how to make a budget. With a little effort, you can save a good amount of money from your salary.

Payoff Your Debts Including Credit Cards

The Federal Deposit Insurance Corp reported that in the third quarter of 2023, Americans owed over $1.05 trillion on their credit cards (Source: Spectrum News). No other time has seen such a high number of debts.

So, avoid falling into this trap as it will have serious consequences on your financial independence.

Try to pay off this debt, not just for your wallet but also for your peace of mind.

So, how do you intend to come out of debt? Here is an illustration:

Think about an imaginary person who has several credit cards plus private debts. The person begins by writing down the liabilities from smallest to biggest. then you can starts to pay a big amount to clear the smallest debt and gives the minimum amount for other credit cards.

After clearing this small loan, that person moves to the next one using money that would have gone toward the first debt.

You can employ this technique if you are in a situation where you owe someone money.

Set Financial Goals (Short and Long Terms)

Financial goal setting is like constructing a wish list for your cash. Consider having a piggy bank and you want to save up for something really cool, let’s say a new video game or even a bicycle.

When you decide what you want to save for, it helps focus your efforts on one target. You are telling money where you want them to go instead of wondering where they went.

To start with, think about both short-term and long-term financial goals.

Short-term financial goals refer to objectives that can be achieved within one year such as paying off credit card debt or saving up for a vacation.

However, long-term goals take more than five years; buying a house and planning for retirement.

Finally, when you set out those goals make sure they are very specific and reasonable. Don’t forget to set up a timeline to achieve these goals.

You should have self-discipline and determination to reach these financial targets. It is not an easy thing but the rewards are worth it if you work hard enough.

Negotiate on Goods and Services and Look for Discounts

I saw many people don’t like to negotiate on the price of a product or service. Some people think it’s a cheap thing to do. But that is not.

Getting the best price negotiation for a product is an excellent practice. If there’s no room for bargaining on prices, then avoid it but if there is, you MUST do that.

Always start your negotiations about goods and services by doing some research. Understand the average prices and do not hesitate to ask for lower prices or extra benefits. Keep in mind that the first price does not always mean the last price. Besides, watch out for discounts and sales.

A lot of stores usually offer seasonal sales or give discounts to specific people like students or retirees. Don’t be afraid to inquire whether any available discounts are applicable to you or not. Thus negotiating and looking for discounts can save you money in the future.

Sometimes buying a membership card will get you more discounts. When you frequently visit any store, buy their membership card to reduce costs in the long run.

Invest for Yourself

You never know when life surprises you. Insurance plays a vital role in those situations. So, try to take essential insurance policies.

Among them include vehicle coverage and family security. Here are some insurances that can help you to gain financial freedom:

- Family Security: Financial protection for loved ones in case of an accident or any other sudden event through life insurance.

- Health Emergency Protection: The expenses used to cover medical issues are usually covered by health insurance, which therefore provides the best healthcare access without economic hardship.

- Home Safeguard: Prevents natural calamities or catastrophes, theft, or unanticipated events.

- Vehicle Coverage: This offers financial indemnity in case of road accidents and theft.

You can also consider the following investments:

- Stocks: A small part that you can own of a company. If the company does well, your part will become more valuable.

- Bonds: Lending money to a company or government. They return it back with extra money after some time.

- Mutual Funds: An assortment of investments such as stocks and bonds that are managed by someone else. It helps spread out risk.

By learning new skills you can earn a good amount of extra money sitting at your home. So, don’t hesitate to invest when you can earn a little extra.

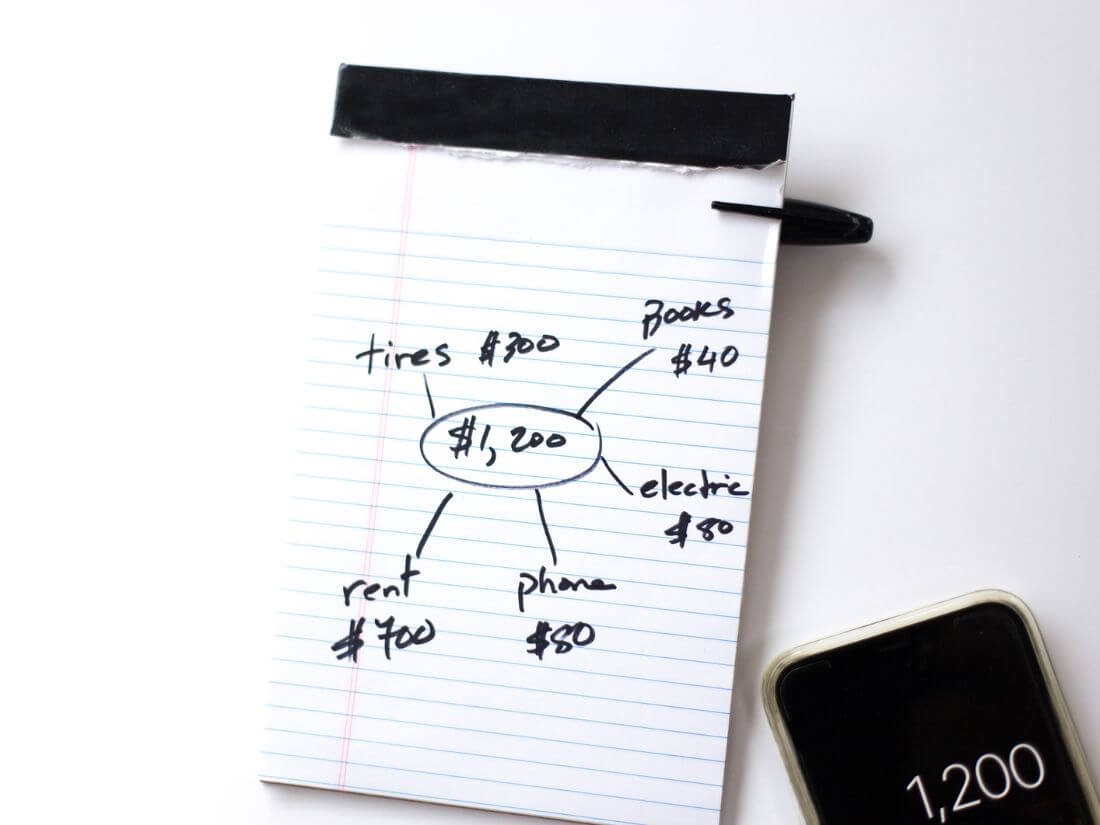

Plan Your Spending Every Month

Think of a budget as a map for your money. It helps you know where to put your money in order not to get lost or run out of cash before the end of the month. Preparing a budget enables you to manage your expenses, save more, and become financially free.

How to create your own budget;

- Determine how much income you are earning: Write down how much salary bring home every month.

- List all financial obligations: List things such as rent, food, and cell phone bills that need your money.

- Set limits on expenditure: Decide what amount can be spent on various things without exhausting the entire sum available.

- Keep tabs on what you spend: Monitor your spending habits so that it aligns with your plan

- Make Changes When Necessary: If you notice that you are spending too much, learn to control it.

Don’t get overwhelmed by other people’s expenditures. Just stick to your plan and you will get your financial freedom in the long run. If you are in business you should also know how to save money from your business.

Save Money for Emergencies

Saving money for emergencies is a vital part of being financially stable. It acts as a fallback, giving confidence and assurance in unexpected events such as illness, vehicle problems or sudden job loss.

How to Save for Emergencies

Here’s how you can start building your safety net:

- Start Small: A few dollars from each paycheck will go far with time.

- Open a Different Savings Account: Keep your emergency money separate from other accounts so that you do not get tempted to use it.

- Make a saving habit: Treat saving like paying monthly bills.

- Cut Down On Extraneous Expenses: Find things that one can do without and channel the money into the emergency account instead.

Read More: HOW TO SAVE $3000 IN 3 MONTHS

Cut Your Unnecessary Expenses

Did you know? The average American spends $1,497 a month on non-essential items, including eating out, entertainment, and shopping for things they don’t need(Source: YourBank). That’s a lot of money that could go into savings or paying off debt.

How You Can Stop Wasting Money:

- Monitor Your Expenditure: Keep a record of everything you pay for over the next month; you may be amazed by some of your findings.

- Ask Yourself “Is It Necessary?”: Delay purchasing anything by twenty-four hours and find out whether it is a must-have for you.

- Explore for Entertainment Options at Lower Cost: Instead of dining out, why not go to the park with snacks?

- Use What You Have: Find out if anything you already have can substitute what you are about to buy.

Never Stop Learning New Things

Seems a bit unorthodox but learning helps a great deal to gain financial freedom.

The more knowledge you acquire, the more you can apply. This is key especially if you want to live a life where money worries are not part of it. Learning doesn’t just mean being smart; it involves becoming better in ways that could increase your income or reduce your expenses.

How Can You Keep Learning?

- Find Free Online Classes: There are a lot of internet sites where you can learn for free. You can learn many things; for example how to create a budget, what investments to make, and even home repair.

- Read Something New Every Day: It could be books, blogs, or news articles. It is through reading that one has different ideas and looks at things from different angles.

- Talk to People Who Are Smarter Than You: Do you know someone who is great with their money or does something interesting? Ask them questions. Most people love sharing their knowledge with others.

- Start Trying New Things: Got a new idea? Do it! Try creating budgets, investing small amounts of money, or starting additional jobs since learning depends on acts.

- Help Other People Learn Something New: If you learn something cool, tell a friend. The best way to understand something perfectly well is to explain it to others.

Set Up Savings on Auto-Pilot

Saving money is not always easy, especially when you have to keep reminding yourself about it every month. But what if your money could save itself without having to engage your mind?

This is where automatic savings come in. It is as though there is a smart robot that takes a little money from you and deposits it into a savings account. This way, you will always be saving and this gets you closer to financial independence without any extra effort.

To start off, first and foremost, decide how much money you want to save every month. Even a small amount is okay.

Thereafter, log into your online bank account and set up an automatic transfer from your checking account into your savings account. Just choose the day that suits you best; perhaps once you receive your salary! That’s all!

Make College Savings a Family Project

Have you ever noticed that the cost of higher education has been increasing every year? This therefore means that by the time your children are ready for college, it may be worth far more than it is today.

Beginning to put money aside early can take away a major headache later.

Opening a special savings account designed specifically for education, like the 529 plan, is one way to start saving for your kids’ college.

This type of scheme offers tax advantages and thus helps the funds grow faster. You and your children may periodically contribute gifts, allowances, or any other extra cash into such an account.

Starting Invest for Your Retirement Future

Making plans for retirement may sound like arranging trips that are miles away. However, as it is with any trip, the earlier you arrange for it, the better it becomes. It is therefore wise to start saving for retirement now.

To begin with, if your employer provides a retirement plan such as 401(k), enrolling will be an excellent idea. In many cases, companies will match some of the money you save which means they give free money towards your future.

If your job has no retirement plan then you can open an Individual Retirement Account (IRA) on your own. Both these alternatives have tax benefits that help savings grow faster.

Afterward, make sure that a small amount of money is regularly deposited in the account. Even if it is from every paycheck and just a tiny amount, these savings will eventually accumulate significantly over time.

Track Your Spending

When you are tracking your spending, it is as if you are the captain of your own boat. You must know where your cash flows are so that you can choose the right approach.

Just begin by noting down every single thing or activity that consumes your money resources starting from high-priced services to small consumables.

Doing this will show how much of your money goes here and there and where you can reduce expenses.

The idea is not about putting an end to all non-essential spending but ensuring that your money is directed towards what matters most to you.

Look at Money Positively

Positive thinking about money can change everything instead of perceiving it as a source of stress; think of it as a medium for living the way you desire.

When you have positive feelings about money, you make wiser decisions regarding it. First, be grateful for your current possessions and set challenging goals in life.

This attitude can keep you motivated to save and spend responsibly.

Take Care of Your Health

On average, the CDC reports that active adults save $1,437 more in health care costs annually than those who are not active.

To be financially free, you must take good care of your health; otherwise, you cannot enjoy the freedom you have fought so hard for.

Besides, it can help cut down on medical bills over time if one is fit. Small things such as eating healthy foods regularly, being physically fit, and having enough rest may play a big role in our lives.

It is like another investment in your future by taking good care of yourself.

You Should Also Know

What is the difference between financial freedom and financial security?

Normally, financial freedom is about being free from the constraints of not having enough money. On the other hand, financial security relates to having sufficient funds for basic needs.

What are some common misconceptions about financial freedom?

- You don’t have to be rich to achieve financial freedom. Living within one’s means, generating passive income, and managing debt can bring financial freedom.

- Having more money does not always mean having more security. Real financial security comes from a regular source of income and prudent spending habits.

- This may seem like a problem but debt doesn’t necessarily compromise your path leading to financial freedom. Good management is vital here.

- Rich people are not the only ones who invest; this is an influential tool for wealth creation and attaining economic independence irrespective of economic status.

How can I overcome the fear of investing to achieve financial freedom?

If you want to get into investing and aim for financial freedom, start by putting in a small amount of money.

Take time to learn about different investment options and the basics of investing. Set clear goals to guide your decisions. Invest regularly, even if it’s just a little. And consider talking to a personal finance expert about your plans.

Are You Ready to Achieve Financial Freedom? Go Get It!

We all want to get financial freedom in our lives but very few people can achieve that. The main reason behind this is poor or no planning and unnecessary expenditure. We should not forget the impact of social media.

Everybody is trying to show how cool his or her life is. But that is not the reality. Everybody has problems in their lives.

So, don’t think who is happy rather plan how you can be happy in your life. And that is the starting point of achieving financial freedom in your life. Start planning NOW!

Read More

What types of Business Should I Start with Low Investment

What Business Can You Start with USD 10K

10 Businesses You Can Start Without Investment

How to Make USD 100 Per Day with Remote Job